Product Name: Olga

Topic / Problem Description:

According to CNBC (2019), the US government spotlights an issue: 78% of US workers live paycheck to paycheck. The saving rate in 2019 shows 7.6% in the US, according to Bea.gov. There are lots of people who do not save for the future but spend it all with new trends like YOLO (You Only Live Once). More people are already giving up to be rich or save money since it is hard to save.

According to Medium (2018), the luxury goods market has always risen up to 18% per year from the year 2000 to the year 2018 expect only five times. This shows that the luxury market was always growing and forecasts more growth, which shows the different graphs from the saving rate in the same periods. More people use the loan to buy luxury goods or things that they do not need.

Most importantly, most people do not know how their money is transacting. It is not easy to keep track of all the details and requires hard work. Most people are not available with fancy wall street personal finance managers. However, with the development of AI, cloud computing, 5G, and tech like Chatbots will make it possible to anyone can experience the benefits of having a personal finance manager for no coast.

Exercising more and saving money are the most popular resolutions throughout many years, but these are hard to be kept. Like the 1year gym membership that you do not go anymore after a few months. It is hard to keep up the work and hard to understand finance for the beginners.

If you want to save more money, you must make more income or make the outcome less. Most people must reduce their outcome in order to save more money since it is not easy to raise income in a short time. Primal research shows that more and more people started to hate rich people since the financial gaps are getting bigger. These hates and negativity will block people from being financially free. It will require significant commitment or desire to be wealthy since there will be no fast, easy and safe way to make money.

How can I help people who want to be financially free but do not know about finance?

Solution:

The main problems are people who start to give up to be financially free or give up to save money because of different reasons. Olga will be a personal finance data analyst/mentor based on given unique data from individual users. Olga will ask questions about different transactions and collect data to find the best plan.

Olga will able to show all the transactions from different cards or banks and able to transact freely without any delays. Olga will ask online receipt from email or take a photo of a paper receipt to track down details of users spending habits for data analysis.

Olga will understand the user as a mentee/friend and keep all records anything that relates to the money transaction. Users will able to see how well they are doing in their plan and how long it should take with this phase. Olga will make the most efficient plan that would work for individual users. The user can also customize the plan.

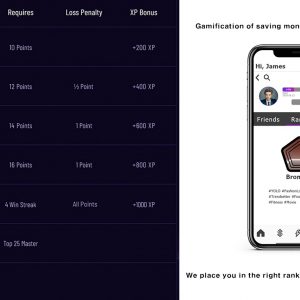

Of course, users can save much faster if someone forces not to spend money, but Olga will try to understand the user and find some point where the user can accept and build better habits. User will able to experience saving money as game that shows with clear numbers even though it might be small.

Olga can help short/long financial goals like “I want to get new handbag” to “I want to save 1million$ in 8years”. Olga will consult with the best possible plan for the user and what the user wants to achieve and keep the users motivated with positive words and valuable information that the user will need to know.

Olga and the user will get smarter as time goes by. Olga will get more intelligent by getting more data from users, and the user will get smarter by Olga, providing valuable information that the user must know about money. The case will be different on how users understand about finance. It will be pinpoint to the user.